The role of the Property Appraiser is to establish the assessed value of real and personal property, grant exemptions, update the tax roll with ownership and address changes, and perform other tax roll corrections as needed.

Transactions to be completed at the property appraiser’s office:

- Homestead Exemption Application or Questions

- Other Exemption Applications or Questions, such as Widows, Low Income Senior, Disabled Veteran, Personal Property etc.

- MH402 - Declaration of Mobile Home as Real Property (must present your mobile home registration(s) at time of application)

- Address/Ownership Changes; Address changes can be made by submitting an electronic change of address form located on manateepao.gov, by email to addresschange@manateepao.gov or in person at the Manatee County Property Appraiser’s Office.

- Maps and Aerial Photos of properties

- Request for Real Property Split or Combine

- Value Proration Sheet

- Closure of a Tangible Personal Property Business Account

- Appraisal/Assessed Value Questions

- TRIM (Truth in Millage) Notices

- Locating a Parcel with no assigned address

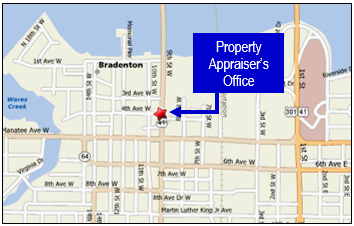

Location of the Property Appraiser's Office

Manatee County Property Appraiser

(Located in Downtown Bradenton)

915 - 4th Avenue West

Bradenton, FL 34205

Phone: 941.748.8208

8:30 AM – 5 PM (Monday – Friday)

manateepao.gov

915 - 4th Avenue West

Bradenton, FL 34205

Phone: 941.748.8208

8:30 AM – 5 PM (Monday – Friday)

manateepao.gov